Dear NINJAs,

I’m currently looking at a variety of jobs to fulfill the experience requirement in California.

One job on my radar is an internal auditing position with a national construction company.

Does internal auditing typically satisfy the attestation requirement?

-Brian

Dear Brian,

It looks like this experience would fall under General Accounting Experience as defined by the California Board of Accountancy and not Attest Experience.

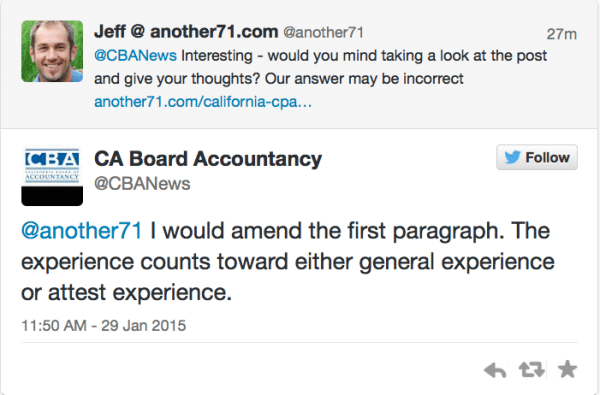

Update: We reached out the CBA for verification and it will count for attest experience.

Let's look at what the CA BOA has to say about a few things:

General Accounting Experience

From the CBA: “For experience to count it must meet the scope of ‘providing any type of service or advice involving the use of accounting, attest, compilation, management advisory, financial advisory, tax, or consulting skills' and is performed under the direct supervision and oversight of a CPA with an active license.”

Link: https://www.calcpa.org/Content/licensure/faq/attest.aspx

Internal Audit (we believe) would fall under this category.

So – your direct supervisor would need to be a CPA with an active license, which might be tricky because many CPAs don't keep their license up-to-date once they leave public accounting and really have no need to sign off on audits or tax returns (because let's face it – CPE is a pain).

If your direct supervisor is an active CPA and will sign off on the experience – then you should be fine ~ assuming you don't want to be able to sign off on attest engagements, which leads us to…

Attest Experience – 500 Hours

From the CBA: “For attest experience, the applicant to demonstrate the ability to understand the requirements of planning and conducting a financial statement audit or perform other attest services with minimum supervision that results in an opinion on full disclosure financial statements.”

Of course…there's also…Pathyway 1 vs Pathway 2 to consider.

The Bottom Line

The CBA's response to our tweet changes the entire scenario. Your experience would count towards the attest experience requirement.

For anyone else who can't make the attest experience happen, you might consider getting the general license first – and then if you really want the attest-signing abilities later on, you can add the attest experience.

Link: https://www.dca.ca.gov/cba/faqs/faqlic.shtml#il-exrequire

From the CBA: “…you can add the attest experience at a later date (after receiving the initial license). You will need to have your supervisor complete and submit the attest experience form to the California Board of Accountancy. The California Board of Accountancy will have to review and approve the quality of your experience before you would be able to sign an audit or review.”

One more link: https://www.another71.com/cpa-exam-forum/topic/will-internal-audit-experience-qualifies-for-the-cpa-work-experience

Caveat

Each state does things their own way. It's a Uniform CPA Examination, but it's not uniform licensing. Ultimately, it's up to the state to make the determination about your experience and it's probably a subjective process, so always contact your state board first before making any sort of career move based on work experience requirements.

-The NINJAs

Have a question for the NINJAs?

Send it here and Jeff will forward it to them via Carrier Pigeon.

Get more Ask the NINJAs